With Pay By Touch reporting the 3,000,000th enrollee for its biometric checkout system fingerscans look set to become even more commonplace – both in store and online

by Penelope Ody* - Retail Bulletin - UK

by Penelope Ody* - Retail Bulletin - UK

A few years ago the taking of fingerprints was something associated with more with the criminal fraternity than with shopping or using computers. Today, helped perhaps by “homeland security” and a willingness to be fingerprinted on arrival at one’s holiday destination, fingerprint ID is not only an acceptable payment mechanism, but increasingly replacing codes and passwords for computer access.

A few years ago the taking of fingerprints was something associated with more with the criminal fraternity than with shopping or using computers. Today, helped perhaps by “homeland security” and a willingness to be fingerprinted on arrival at one’s holiday destination, fingerprint ID is not only an acceptable payment mechanism, but increasingly replacing codes and passwords for computer access.

Last month, Pay By Touch – now used at around 2,500 locations in the US as well as at several branches of Midcounties Co-op in the UK – announced that the three millionth shopper (they now report 3.3 Million enrollees) to enroll fingerprints in the system had signed up at a Jewel-Osco grocery store in Chicago. The excited shopper (rewarded with $1,000) declared that her kids believed the payment system was “cool” and it was all a great deal safer and easier than debit cards of “digging through my purse” in search of cash.

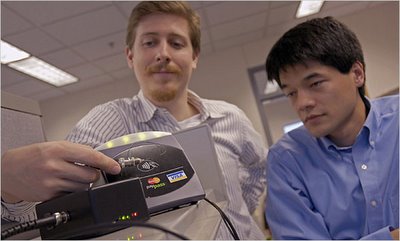

Pay By Touch has followed with the launch of an Internet fingerprint ID technology called TrueMe that can be used to access websites and web accounts securely. Working with biometric security solutions provider UPEK, Pay By Touch is providing a USB plug-in finger sensor where the technology is not yet incorporated into PCs.

To sign up, users touch the finger sensor which encrypts information about the print and this – along with the device ID – is sent to central TrueMe servers for authentication.

When users then want to access a particular web account all they need do is touch the sensor and details of both sensor and print are again authenticated by the TrueMe systems before a secure connection notifies the website or service concerned that the user is indeed genuine.

“With the continued growth of identity theft, credit card fraud and phishing scams, security on the Internet is more important than ever,” says John Rogers, chairman and ceo of Pay by Touch. “TrueMe brings the security and protection of biometric services to the Internet, providing a new layer of privacy and convenience for PC users everywhere.”

The technology would certainly be a boon to Internet Retailers, when shoppers who often abandon carts – or indeed fail to enter retail websites – because they forget passwords or disable cookies on their PCs.

Using a Pay By Touch approach for Internet purchases could also reduce online card fraud. Last year cardholder-not-present fraud rose by 21% to £183.2million, according to APACS, while a YouGov survey commissioned by Computer Associates in the summer suggested that only 21% of online shoppers trusted e-tailers to manage cardholder data securely.

With the difficulties of achieving PCI DSS compliance likely to remain a major ongoing concern for many retailers for some time to come, it seems inevitable that public perceptions of online security and rising rates of CNP theft will continue for some time.

A growing number of laptops and desktop PCs are being equipped with fingerprint sensors which will help drive the TrueMe service. Lenova (which bought IBM) has certified TrueMe for millions of it's laptops including their ThinkPads.

The Pay By Touch technology is also being applied to in-store devices such as EPoS terminals and kiosks. For example, both NCR’s FastLane is already equipped with Pay By Touch technology to help drive security on their popular self-checkout machines.

With partners that include NCR, IBM, Discover, Accenture, Retalix, Radiant Systems, Lenova, Verifone, Ingenico, and more, look for 2007 to be the "year of biometrics".

by Penelope Ody* - Retail Bulletin - UK

by Penelope Ody* - Retail Bulletin - UK  A few years ago the taking of fingerprints was something associated with more with the criminal fraternity than with shopping or using computers. Today, helped perhaps by “homeland security” and a willingness to be fingerprinted on arrival at one’s holiday destination, fingerprint ID is not only an acceptable payment mechanism, but increasingly replacing codes and passwords for computer access.

A few years ago the taking of fingerprints was something associated with more with the criminal fraternity than with shopping or using computers. Today, helped perhaps by “homeland security” and a willingness to be fingerprinted on arrival at one’s holiday destination, fingerprint ID is not only an acceptable payment mechanism, but increasingly replacing codes and passwords for computer access.Last month, Pay By Touch – now used at around 2,500 locations in the US as well as at several branches of Midcounties Co-op in the UK – announced that the three millionth shopper (they now report 3.3 Million enrollees) to enroll fingerprints in the system had signed up at a Jewel-Osco grocery store in Chicago. The excited shopper (rewarded with $1,000) declared that her kids believed the payment system was “cool” and it was all a great deal safer and easier than debit cards of “digging through my purse” in search of cash.

Pay By Touch has followed with the launch of an Internet fingerprint ID technology called TrueMe that can be used to access websites and web accounts securely. Working with biometric security solutions provider UPEK, Pay By Touch is providing a USB plug-in finger sensor where the technology is not yet incorporated into PCs.

To sign up, users touch the finger sensor which encrypts information about the print and this – along with the device ID – is sent to central TrueMe servers for authentication.

When users then want to access a particular web account all they need do is touch the sensor and details of both sensor and print are again authenticated by the TrueMe systems before a secure connection notifies the website or service concerned that the user is indeed genuine.

“With the continued growth of identity theft, credit card fraud and phishing scams, security on the Internet is more important than ever,” says John Rogers, chairman and ceo of Pay by Touch. “TrueMe brings the security and protection of biometric services to the Internet, providing a new layer of privacy and convenience for PC users everywhere.”

The technology would certainly be a boon to Internet Retailers, when shoppers who often abandon carts – or indeed fail to enter retail websites – because they forget passwords or disable cookies on their PCs.

Using a Pay By Touch approach for Internet purchases could also reduce online card fraud. Last year cardholder-not-present fraud rose by 21% to £183.2million, according to APACS, while a YouGov survey commissioned by Computer Associates in the summer suggested that only 21% of online shoppers trusted e-tailers to manage cardholder data securely.

With the difficulties of achieving PCI DSS compliance likely to remain a major ongoing concern for many retailers for some time to come, it seems inevitable that public perceptions of online security and rising rates of CNP theft will continue for some time.

A growing number of laptops and desktop PCs are being equipped with fingerprint sensors which will help drive the TrueMe service. Lenova (which bought IBM) has certified TrueMe for millions of it's laptops including their ThinkPads.

The Pay By Touch technology is also being applied to in-store devices such as EPoS terminals and kiosks. For example, both NCR’s FastLane is already equipped with Pay By Touch technology to help drive security on their popular self-checkout machines.

With partners that include NCR, IBM, Discover, Accenture, Retalix, Radiant Systems, Lenova, Verifone, Ingenico, and more, look for 2007 to be the "year of biometrics".

.jpg)