It’s no money, no plastic, no problem at Scott’s Food & Pharmacy locations for those who have arranged to debit their checking accounts with a fingerprint scan.

It’s no money, no plastic, no problem at Scott’s Food & Pharmacy locations for those who have arranged to debit their checking accounts with a fingerprint scan.Scott’s is the first grocery-store chain in Indiana to implement the biometric payment service. Executives with the chain tested it in four stores early this month then rolled it out to the remaining 14 after they were satisfied with the results.

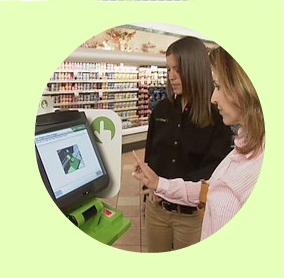

The new Pay By Touch technology is running now in every lane at all 18 locations of the area supermarket chain, and “people signing up have been very positive about it because it’s going to save them a lot of hassle,” said Rick Zahm, vice president for merchandising and operations.

The new Pay By Touch technology is running now in every lane at all 18 locations of the area supermarket chain, and “people signing up have been very positive about it because it’s going to save them a lot of hassle,” said Rick Zahm, vice president for merchandising and operations.Pay By Touch developed the system Scott’s is using to debit a shopper’s checking account via a secure finger scan, in the same way that swiping a debit or check card provides account access. The company says finger scans are more secure than paper checks or debit cards because the account numbers are not visible to anyone at the checkout lane, even store associates.

And it is the kind of technology that disappoints pickpockets, said Rod LaFleur, a Pay By Touch regional sales representative.“If you’re not carrying a purse or wallet, there’s nothing to be stolen,” he said.

And it is the kind of technology that disappoints pickpockets, said Rod LaFleur, a Pay By Touch regional sales representative.“If you’re not carrying a purse or wallet, there’s nothing to be stolen,” he said.Scott’s is the first grocery-store chain in Indiana to implement the biometric payment service. Executives with the chain tested it in four stores early this month then rolled it out to the remaining 14 after they were satisfied with the results.

Signing up for the free service requires a canceled check, a driver’s license or electronic benefits transfer card, and an initial finger scan.“If you took a fingerprint, there are certain points unique to each individual. That’s what is kept on file,” Zahm said. “The sign-up only takes about two minutes.”

The transaction generates a receipt without an account number and is quicker than a standard debit-card transaction, he said. The technology is in most major cities but hasn’t made it to Indianapolis yet.

LaFleur said Pay By Touch is operating at 2,400 locations in 44 states. A retailer pays between 8 cents and 10 cents per transaction, but that is less expensive than the cost of an average debit-card transaction, he said. The service usually boosts sales enough to more than cover its cost, he said. Pay By Touch drives sales because customers shop more when the line at the checkout lane moves faster and when spending isn’t limited by the amount of cash they’re carrying, LaFleur said.

.jpg)