Mercator Advisory Group has released a new report titled "The Online Opportunity for PIN-Based and "PIN-Less" Debit" which discusses market opportunities to expand usage of PIN-based debit cards in the online environment.

Mercator Advisory Group has released a new report titled "The Online Opportunity for PIN-Based and "PIN-Less" Debit" which discusses market opportunities to expand usage of PIN-based debit cards in the online environment.According to the report... "Today's lack of a widely accepted solution for using PINs online has limited the use of EFT debit in this rapidly expanding market." The report goes on to say...

"Long-term opportunities in the fast-growing e-commerce segment must await the deployment of a proven online PIN technology."

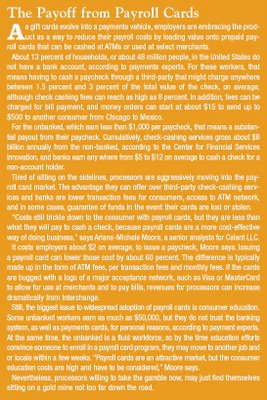

PIN debit at the point-of-sale has grown rapidly, and consumers often favor the use of PIN over signature debit for its perceived security and ease of use. The report tracks debit's growth and key consumer attitudes driving its growth. In the world of e-commerce, debit usage, essentially restricted to signature debit usage, has also grown impressively.

While the e-commerce segment its modest in sales volume today when compared with the total consumer spending market, its rapid growth makes it strategically important as a source of future payment volume.

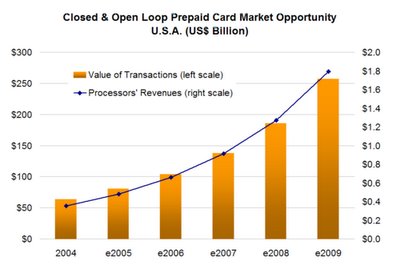

Mercator's analysis suggest that in 2005 dollars, PIN debit's "fair share" of the e-commerce segment would be $12 billion in sales volume, if a suitable authentication solution were available to ATM cardholders.

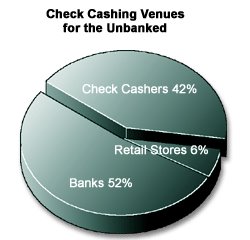

The inherently low fraud associated with payments to utilities, educational institutions, financial institutions and other selected categories ensures that transactions authorized by billers and ATM card issuers result in very low fraud rates, even though they are not PIN-secured. Most of these PIN-less payments are for expedited/late pay consumer bills, and miss the huge volume opportunity of pre-authorized recurring payments.

The report estimates the potential market opportunity that could be addressed if PIN debit were allowed as a competitive payment option for recurring bills.

Editors Note: Pay By Touch owns the rights to the world's first and only software based PIN Debit application via their subsidiary, ATM Direct. For a closer look at ATM Direct, (which was featured here on February 13th) click the following link:

Editors Note: Pay By Touch owns the rights to the world's first and only software based PIN Debit application via their subsidiary, ATM Direct. For a closer look at ATM Direct, (which was featured here on February 13th) click the following link: If Pay by Touch, is indeed, awarded their patent (which is currently pending) for Internet PIN Debit, then ATM Direct, combined with PBT Online, would become a cash register for Pay by Touch. They would be positioned to cut Internet Retailer's transaction processing costs in half and own the market, which in turn would boost their stock value significantly come IPO time. For further information, I've included some interesting reading below:

Related Links:

ATM Direct Says It Will Test PIN Debit on the Web This Year

Pay By Touch Closes in on 'Biometric Proxy' for PIN in Debit Payments

Pay By Touch Enters the Race to Offer Payments to Web Merchants

.jpg)