Friday, October 20, 2006

Mary Vanac - Plain Dealer Reporter

The latest technology at Zagara's Marketplace definitely has "the cool factor," in the words of store manager Dan Gradijan.

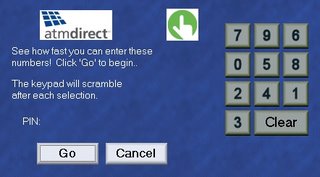

This week, the Cleveland Heights grocer became the first retailer in Northeast Ohio to offer the Pay By Touch Wallet -- a point-of-sale system that enables customers to pay for groceries by scanning their index fingers and keying in a number. There's no need for checks, credit or debit cards, or cash, all of which can be stolen. "Nobody can steal your fingerprint," Gradijan said. The biometrics system that verifies your identity and enables you to write an electronic check on your account also is less costly to use -- for both consumers and retailers.

This week, the Cleveland Heights grocer became the first retailer in Northeast Ohio to offer the Pay By Touch Wallet -- a point-of-sale system that enables customers to pay for groceries by scanning their index fingers and keying in a number. There's no need for checks, credit or debit cards, or cash, all of which can be stolen. "Nobody can steal your fingerprint," Gradijan said. The biometrics system that verifies your identity and enables you to write an electronic check on your account also is less costly to use -- for both consumers and retailers.Store director John Zagara approached Pay By Touch about a year ago, Espinosa said. Zagara had read about the finger-scan technology. "He's an innovative guy," Espinosa said of Zagara, whose grandfather, Charles, opened the first Zagara's on Kinsman Road in 1936. Zagara was unavailable for comment on Thursday.

"I give them a lot of credit" for installing the Pay By Touch technology, said David Hogan, chief information officer for the National Retail Federation in Washington.

"I give them a lot of credit" for installing the Pay By Touch technology, said David Hogan, chief information officer for the National Retail Federation in Washington. Convenience and speed are the likely reasons why customers at grocery stores, and perhaps convenience stores and gas stations, might adopt biometric checkout technology, Hogan said. "If you're a parent and you've got a toddler on your hip, you can scan your finger and punch in a number, and you're on your way," he said.

Pay By Touch, which bought its nearest competitor, BioPay, earlier this year, is the clear leader in biometric point-of-sale technology, the retail federation's Hogan said. In some form, biometrics probably is coming to a store near you. "A lot of retailers are finding payment solutions with biometrics very appealing," Hogan said.

About David Hogan

About David HoganDavid Hogan was named Senior Vice President and Chief Information Officer for the National Retail Federation (NRF), the world's largest retail trade association, in 2002. He directs numerous internal and retail industry IT initiatives and manages NRF's CIO Council, a committee of retailing's most prominent chief information officers. Dave also provides oversight for the Association for Retail Technology Standards (ARTS), dedicated to creating an international, barrier-free technology environment for retailers.

Hogan is a former member of the NRF's CIO Council and has spent his entire career in retail. Prior to joining NRF, he served as Vice President and CIO of international retailer, Duty Free Americas. He has held senior level positions with The Limited Inc. serving as Business Unit CIO for their Lane Bryant division and Vice President of MIS for specialty footwear retailer, The Kobacker Company.

Back to the Story...

Security of private financial information also is an adoption factor, Espinosa said. Pay By Touch patrons don't use checks, or debit or credit cards, so their account numbers aren't visible to clerks or other shoppers. Patrons also don't use a personal identification number that is tied to their checking accounts.

Sophisticated technology underneath each checkout counter encrypts customers' digitized fingerprints and search numbers, Espinosa said. This information is sent to a high-security data center managed by IBM. Pay By Touch generally subtracts your grocery bill from your checking account overnight.

The Pay By Touch technology might help speed customers through Zagara's already speedy checkout lines. "Our wait time and checkout time is 1½ minutes," on average, store manager Gradijan said.

Zagara's customers can start their finger scans after the clerk scans their first grocery item. By the time all of the grocery items are scanned, the customer can approve the payment amount by hitting the "yes" button on the touch pad at the cashier's station.

The electronic check transaction that results is free to the customer, Espinosa said. The e-check transaction costs less than half of what a credit card transaction would for the retailer, Gradijan said.

The California company's system is installed in about a dozen stores in Ohio, including a few Sunflower Markets in Columbus and a Biggs Hypermarket in Cincinnati, Espinosa said.

Pay By Touch also makes other financial systems, including one that uses biometrics to authenticate people who cash their payroll checks at grocery stores, Espinosa said.

To reach this Plain Dealer reporter:

mvanac@plaind.com, 216-999-5302

.jpg)