Self-Service Kiosks

Do your shoppers receive “Loyalty Cards” without giving you complete enrollment information? Do you regard the “Loyalty Card” as anything more than a discount card from which any shopper can benefit?

Do your shoppers receive “Loyalty Cards” without giving you complete enrollment information? Do you regard the “Loyalty Card” as anything more than a discount card from which any shopper can benefit?If you are serious about rewarding good shoppers on a personalized basis to increase their level of loyalty to your stores, you must look carefully at your enrollment process.

Although Pay By Touch Personalized Marketing uses edits and sophisticated data entry tools to maximize the value of information from traditional paper-based enrollments to Reward Programs, there are inherent obstacles in such a process that keep you from successful communication with all of your loyal shoppers.

In a traditional paper process, enrollment data cannot always be checked for accuracy, completeness, or validity before a card is issued, for card-based enrollees. It often can be weeks, or longer, before store personnel submit the paper applications for data entry. There is no way you can communicate with these shoppers during this time.

SmartShop™ includes self-service kiosk enrollments that can be biometric (finger scan) or card-based. Time used by store personnel is reduced, enrollment information is automatically populated via Drivers Licence scan or real-time reverse phone append to assure accuracy, and the profile information is immediately added to your database.

SmartShop™ includes self-service kiosk enrollments that can be biometric (finger scan) or card-based. Time used by store personnel is reduced, enrollment information is automatically populated via Drivers Licence scan or real-time reverse phone append to assure accuracy, and the profile information is immediately added to your database.Requiring only an electrical outlet, these kiosks offer ease of placement due to wireless technology. Splash screen content can display variable specials and promotions.

The kiosks offer additional revenue opportunities from manufacturer advertising, and they are centrally monitored for maintenance and performance requirements.

Each kiosk is also capable of dispensing custom printed gift cards.

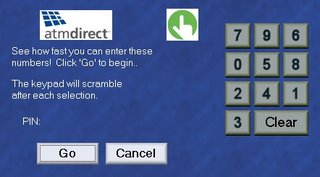

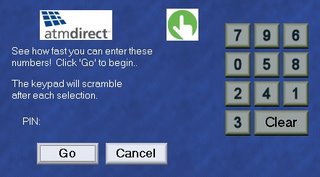

Click the picture above to enlarge and read.

.jpg)