An Idea on How Pay by Touch can "Discover" the PrePaid Touch

Both Pay by Touch and our "strategic partner" Discover have yet to "aggressively" pursue the PrePaid Debit Market. How can we propel ourselves into this industry?

BioPay's Paycheck Secure program, already has 1500+ locations with over 2 million enrollees. According to BioPay, they have cashed approximately $7 Billion dollars worth of checks since it's inception. Most of these have been payroll checks, so for illustration purposes, let's suppose that the average payroll check is $500. This would equivocate to 14 million checks cashed...which means that they earned a transaction fee on 14 million transactions.

BioPay's Paycheck Secure program, already has 1500+ locations with over 2 million enrollees. According to BioPay, they have cashed approximately $7 Billion dollars worth of checks since it's inception. Most of these have been payroll checks, so for illustration purposes, let's suppose that the average payroll check is $500. This would equivocate to 14 million checks cashed...which means that they earned a transaction fee on 14 million transactions.

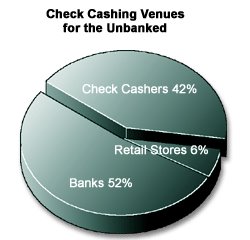

A vast majority of these checks are being cashed by the unbanked or underbanked, which is 20+ million consumers strong. (half of which are of Hispanic descent)

A vast majority of these checks are being cashed by the unbanked or underbanked, which is 20+ million consumers strong. (half of which are of Hispanic descent)

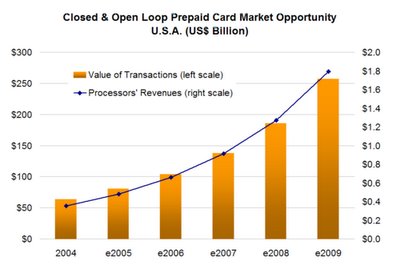

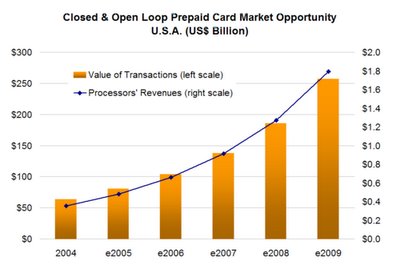

The prepaid market represents a fast-growing market opportunity for Pay by Touch.. Closed and open loop prepaid processors will generate about US $1.8 billion in revenues by 2009, up from about US $0.5 billion in 2004.

By 2009, prepaid processing will be as large an industry as the debit card and ATM processing industry was in 2004. (Prepaid Trends - March 15th 2006)

“In coming years, sheer size and rapid growth will place the prepaid market at the forefront of the competition among card processors,” adds Gwen Bézard from Aite Research Group. The report predicts that, over the coming years, card networks will continue to struggle to accommodate the unique requirements of prepaid debit cards, "creating opportunities for third-party processors to innovate" on top of the network utility.

Both Pay by Touch and our "strategic partner" Discover have yet to "aggressively" pursue the PrePaid Debit Market. How can we propel ourselves into this industry?

BioPay's Paycheck Secure program, already has 1500+ locations with over 2 million enrollees. According to BioPay, they have cashed approximately $7 Billion dollars worth of checks since it's inception. Most of these have been payroll checks, so for illustration purposes, let's suppose that the average payroll check is $500. This would equivocate to 14 million checks cashed...which means that they earned a transaction fee on 14 million transactions.

BioPay's Paycheck Secure program, already has 1500+ locations with over 2 million enrollees. According to BioPay, they have cashed approximately $7 Billion dollars worth of checks since it's inception. Most of these have been payroll checks, so for illustration purposes, let's suppose that the average payroll check is $500. This would equivocate to 14 million checks cashed...which means that they earned a transaction fee on 14 million transactions. A vast majority of these checks are being cashed by the unbanked or underbanked, which is 20+ million consumers strong. (half of which are of Hispanic descent)

A vast majority of these checks are being cashed by the unbanked or underbanked, which is 20+ million consumers strong. (half of which are of Hispanic descent)The prepaid market represents a fast-growing market opportunity for Pay by Touch.. Closed and open loop prepaid processors will generate about US $1.8 billion in revenues by 2009, up from about US $0.5 billion in 2004.

By 2009, prepaid processing will be as large an industry as the debit card and ATM processing industry was in 2004. (Prepaid Trends - March 15th 2006)

“In coming years, sheer size and rapid growth will place the prepaid market at the forefront of the competition among card processors,” adds Gwen Bézard from Aite Research Group. The report predicts that, over the coming years, card networks will continue to struggle to accommodate the unique requirements of prepaid debit cards, "creating opportunities for third-party processors to innovate" on top of the network utility.

Pay by Touch "Prepaid Discover Card

Rather than having a Pay By Touch retailer dole out $500 in cash, I would suggest that the retailer offer an open loop Discover/PBT PrePaid Debit Card.

With Discover's recent announcement that they'll accept all DiscoverCard's at Pulse ATM's, this particular prepaid card could be used to withdraw cash at 350,000 Pulse ATM's, in addition to transacting purchases at any retailer who accepts Discover. (or PBT)

With Discover's recent announcement that they'll accept all DiscoverCard's at Pulse ATM's, this particular prepaid card could be used to withdraw cash at 350,000 Pulse ATM's, in addition to transacting purchases at any retailer who accepts Discover. (or PBT)Currently, Pay By Touch earns a "one-time" transaction fee from cashing a $500 check, but, assuming an average purchase of $50 with the PBT/Discover Prepaid card, PBT would derive 10 transaction fees, or 10 times more activity.

Thus, 14 million transactions, become 140 Milllion transactions. Pay by Touch offers a stored value card but a reloadable DiscoverCard would offer more flexibililty. If the goal is to have customers flock towards the product, we would have to offer something unique and desirable which has not been offered before, by any finanical institution or card provider.

Leveraging PrePaid as a Means to Establishing Credit

Could Pay By Touch leverage their relationship with Discover and offer a PrePaid Card which also serves as a steppingstone to establishing credit? (which would result in attracting a tremendously huge market) Can anyone for that matter?

According to PrePaid Trends, "That's the question that pioneers in the prepaid card and banking industry are moving aggressively to answer in order to create credit records for millions of Americans"

According to PrePaid Trends, "That's the question that pioneers in the prepaid card and banking industry are moving aggressively to answer in order to create credit records for millions of Americans""Finding a solution to the the age-old dilemma that young, often minority and unbanked consumers have always faced... How do I build a credit record if no one will give me credit? Solving that question could identify millions of hard-working consumers who would make good customers."

Discover the Answer

Here's my suggestion as the solution to this "age-old diemma. Pay by Touch could utilize their existing strategic partnership with Discover, and introduce an innovative rewards program attached to their PrePaid card.

Here's my suggestion as the solution to this "age-old diemma. Pay by Touch could utilize their existing strategic partnership with Discover, and introduce an innovative rewards program attached to their PrePaid card.The idea of "cash back" was pioneered by Discover back in 1987, according to Robert McKinley, CEO of www.CardWeb.com, and today every top issuer has some type of cash back or reward program.

But what kind of rewards would best appeal to the un/underbanked? Let's look this from a reverse angle. The inverse of cash rewards are credit rewards, an appurtenant to what Discover pioneered in '87.

Credit Rewards For Using Cash (Diametrics)

The antithesis to providing "cash rewards" for using credit, is that Pay by Touch would provide, "credit rewards" for using cash" (via a co-branded PBT/Discover Prepaid Card)

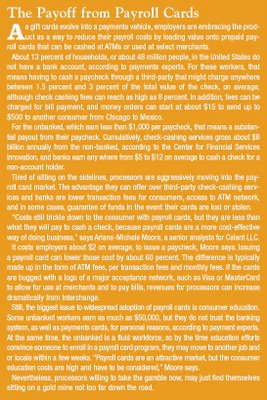

Here's how I would suggest it might work: Let's say a consumer cashed a payroll check at a PBT retailer for $500. I don't have data on whether or not they come back "week after week" to cash their payroll checks, but wouldn't we like them to? If so, then let's make them an offer that "entices them to do just that".

Here's how I would suggest it might work: Let's say a consumer cashed a payroll check at a PBT retailer for $500. I don't have data on whether or not they come back "week after week" to cash their payroll checks, but wouldn't we like them to? If so, then let's make them an offer that "entices them to do just that".To entice the payroll check casher into coming back "week after week" thus enhancing loyalty on their part, PBT could introduce an innovative and (after conducting an exhaustive Google search, I'm convinced, a) "unique" new program, which offers a credit building reward.

If a consumer cashes their check with us every week or two weeks and has their funds loaded onto our Prepaid PBT/DiscoverCard, then, after 3 months, the average balance on their card will be the variable that drives the the Discover Credit Reward Perk. They vest at 25% every 3 months.

What this means is that they'll be issued (making PBT an issuer) a Discover "Credit" Card with 25% of their average balance as a credit-line perk. After 6 months it becomes 50% vested and after 9 months, the average balance becomes 75% vested. At the 12 month mark, they have the opportunity to be 100% vested.

What this means is that they'll be issued (making PBT an issuer) a Discover "Credit" Card with 25% of their average balance as a credit-line perk. After 6 months it becomes 50% vested and after 9 months, the average balance becomes 75% vested. At the 12 month mark, they have the opportunity to be 100% vested.There are stipulations, such as them agreeing, during the provisional period of building a credit line reward, that the minimum monthly payment on the credit card is automatically deducted on the due date from the Prepaid card. This of course would mitigate risk. (We might also stipulate that they pay at least one-bill per month using the card, as a gateway into the bill payment sector.)

Thus, if the consumers average balance on the PrePaid card is $1000 after 3 months, they'll have a $250 credit line on a Discover Credit card, which will become $500 after 6 months, $750 after 9 and $1000 after 12 months, provided they have made timely payments. Crazy you say? Not so fast. Allow me to prove my point that this is the way of the future...(not unlike biometric payments were when we bought Indivos).

Estimates are that as many as 50 million Americans do not qualify for credit. Hugh Gallagher, a manager in the Atlanta office of consulting company Edgar, Dunn & Company believes that about 20 million of them are ripe to be targeted for using prepaid cards and stored value data to build a credit history.

"It would be a big deal for financial service companies if prepaid data could help 20 million Americans qualify for credit cards, mortgages and loans," he says. "There is so much opportunity for incremental revenue by going after the unbanked and those without credit and that is why there are so many players going after this segment."

"A prepaid card could tell credit bureaus and and potential lenders a lot about an individual. "If such data from prepaid cards were to become accepted as a way to build credit history, it would be a "boon" for the prepaid card industry because unproven customers "would flock" to the product. And top on their wish list would be "open-loop" prepaid cards that carry such brands as Visa, MasterCard, AMEX and Discover."

Thus, if Pay by Touch could issue a Prepaid DiscoverCard that says: "My product meets your financial needs today, and can help you climb the ladder in the future for other credit products, we will harness consumers, not only initially, but long-term as well, with more frequency.

Prepaid Trends, in their March 15th issue, states that consumer data house Experian, Inc. may be drawing close to creating the predictive model for using prepaid card data in this way.

"We believe that by the end of the calendar year, we will come up with a tangible model that will allow us to use data from prepaid cards as a legitamate source for establishing credit," says Mark Hall, Experian's director of strategic initiatives.

"We believe that by the end of the calendar year, we will come up with a tangible model that will allow us to use data from prepaid cards as a legitamate source for establishing credit," says Mark Hall, Experian's director of strategic initiatives.Prepaid Trends says that Experian's working theory is that the prepaid card data will show that cardholders are making, or not making, timely payments on reucrring bills or monthly fees. Hall says Experian is looking to create positive credit files that show individuals are paying their bills on time, rather than just collecting negative data reflecting late payments. Last April, Experian created a payments industry advisory committee, including top card processors, issuers and networks to help it build the model.

So the writing is on the wall, as was biometrics. This could be a major marketing point for issuers, which Pay by Touch could become. Of course everyone that cashes a check that is loaded onto our prepaid card also must enroll with Pay by Touch, thus poetentially vastly increasing our enrollment numbers.

So while we wait for Experian to complete their findings by the end of the year, we could get started now and have a tremendously huge jump start on the industry.

Their are details to be worked out, I know...and I have some ideas, but I believe that this concept merits further attention, especially considering we would be the first to do it, we're not currently in the industry and by 2009, this market, as I've previously stated is going to be as big as the debit/ATM industry was in 2004.

Besides a way to attract the un/underbanked and Hispanic market, some of the more prevalent benefits provided are as follows:

1. PBT creates repeat/loyal payroll check cashing customers

2. PBT vastly increases the number of transactions they earn a transaction fee on.

3. PBT has an entrance into the prepaid card market.

4. PBT becomes an issuer

5. PBT retailers don't have to dole out so much cash when cashing a payroll check

6. The check casher doesn't have to (dangerously) walk out of a retail establishment with a wad of cash.

7. The un/derbanked consumer has a short and long term incentive towards building a relationship with us

8. A spending history is established that we can track

9. The un/derbanked consumer is rewarded for loyalty with a short/medium and long term goal of establishing credit.

10. Discover/PBT is able to issue two cards, where previously they have issued none...the prepaid card itself, and the future credit card.

11. Risk is mitigated, because the spending history is established, the average balance is established and the consumer agrees that the monthly minimum payment on the Discover Credit Card is automatically paid.

12. Instead of approaching companies about issuing Payroll cards, we bypass the middleman and go after the check casher.

13. Offers the opportunity to partner with existing check cashing outlets such as the 1520 locations of Ace Cash Express, the 1500+ location CashNow and 1329 locations of Dollar Financial Groups Money Store (In all there are over 22,000 check cashing/payday lending locations nationwide.

14. Allows us to penetrate banks and credit unions and cross sell our payment solutions via our Agent Bank Program. (Ironically, banks cash 52% of the unbanked consumers checks, and yes, most require that you roll you finger on an inkpad to leave a fingerprint. (so our biometric identification program would be a softsell compared to that.) According to the March 2006 issue of Bank Sytems & Technology, only 5-7% of U.S. financial institutions have deployed biometric technologies, however, banks finally seem to understand the technology, prices for biometric devices are down, and projections are that 35% of banks will install biometrics by the end of 2007. So it's a great vertical, especially considering how Pay by Touch Online can benefit as well.

14. Allows us to penetrate banks and credit unions and cross sell our payment solutions via our Agent Bank Program. (Ironically, banks cash 52% of the unbanked consumers checks, and yes, most require that you roll you finger on an inkpad to leave a fingerprint. (so our biometric identification program would be a softsell compared to that.) According to the March 2006 issue of Bank Sytems & Technology, only 5-7% of U.S. financial institutions have deployed biometric technologies, however, banks finally seem to understand the technology, prices for biometric devices are down, and projections are that 35% of banks will install biometrics by the end of 2007. So it's a great vertical, especially considering how Pay by Touch Online can benefit as well.15. Increases Pay by Touch enrollments and usage.

16. Creates another angle to go after Wal*Mart (who is the largest check casher in the US and a Discover Partner as well) A Wal*Mart Discover/PBT card?

17. We could require as part of the program that the consumer use this card to pay at least one bill per month as part of the credit building process, which gets us into the Bill Payments sector as well.

.jpg)