Digital fingerprint technology holds key to your security and convenience

Pay for the groceries, lock the house, start the car, check in at a doctor's office or log on to a laptop. There's so much the swipe of a fingertip can do.

Pay for the groceries, lock the house, start the car, check in at a doctor's office or log on to a laptop. There's so much the swipe of a fingertip can do.

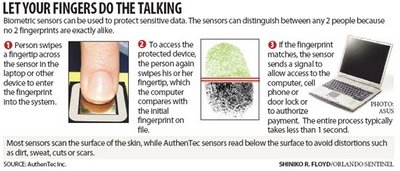

An evolving digital tool, biometric-fingerprint technology holds the promise of replacing or lessening reliance on everyday necessities such as credit cards, key chains and passwords. It even helps registered travelers get through security at Orlando International Airport.

An evangelist of biometrics, Scott Moody is CEO of AuthenTec, a Melbourne company that produces sensors that can read a fingerprint."Looking ahead, I think the use of this technology could become ubiquitous," he said, gazing out the window of his office overlooking the Indian River. "It would just be taken for granted as part of the everyday world."Moody's 8-year-old firm, which employs 89, has grown rapidly, thanks to four infusions of venture capital totaling $63.5 million, with shipments increasing in the past three years from 1.5 million to a projected 7 million to 8 million units in 2006. AuthenTec is among several global suppliers for a market comprising computers, cell phones, home security, autos and building-access controls, presenting a target of about 1 billion sales worth $5 billion to $10 billion this year, Moody said.

Biometric-fingerprint readers are housed in a bit of silicon not much bigger than a fingernail clipping yet powerful enough to capture a fingerprint image that, when magnified, looks like closely packed mountains and valleys in a desert landscape. The silicon slivers are seen as a tool for safeguarding sensitive personal and financial data stored on laptops used by the military, banks, businesses and medical firms. Many business-model laptops now have the biometric devices, said Ray Sawall, Gateway senior manager for professional-notebook management.

Beyond security, convenience could be a major driver for wider adoption in the consumer world, said Forrester Research analyst Jonathan Penn, who sees biometric devices as a tool for making purchases at the supermarket and other stores."I can get through the checkout line faster, and I don't have to carry cash or a debit or credit card," he said.

A fingerprint-scanning device linked to bank or credit-card accounts, developed by Pay By Touch of San Francisco, is in use at about 2,500 sites across the country, including Coast to Coast, a Tampa convenience store.

A fingerprint-scanning device linked to bank or credit-card accounts, developed by Pay By Touch of San Francisco, is in use at about 2,500 sites across the country, including Coast to Coast, a Tampa convenience store.

Future uses include the ability to pay at the pump for gas and register for a visit at a doctor's office with a finger swipe, said John Morris, Pay By Touch president.

Individuals seeking to cash payroll or government checks can use a similar biometric tool, called Paycheck Secure, also developed and powered by Pay By Touch technology, at Zions Bank of Utah. "It's convenient for customers, and it keeps us from being defrauded," said David Fuhriman, senior vice president of retail-product management.

Individuals seeking to cash payroll or government checks can use a similar biometric tool, called Paycheck Secure, also developed and powered by Pay By Touch technology, at Zions Bank of Utah. "It's convenient for customers, and it keeps us from being defrauded," said David Fuhriman, senior vice president of retail-product management.

Still another version of the technology is a key-chain fob, called plusID, developed by Privaris Inc., a privately held firm in Charlottesville, Va. The 1-inch-long device, which uses an AuthenTec sensor, is a security tool to unlock doors and log on to computers at businesses, Privaris President and CEO Barry Johnson said. It could also be used to lock and unlock home and car doors, he said. But before biometric technology replaces credit cards and makes the key ring obsolete, barriers remain, industry analysts and experts said.

The $5 sensors are still too pricey for mass adoption; there is little awareness of and even less demand for them; and some concerns linger about how secure they really are, experts said. "There's value in it for locking a phone or navigating games," said Chris Bierbaum, Sprint Nextel Innovation Manager."But the price has to come down for a cell-phone carrier to deploy it. And I want to see more testing on security. I need to see confirmation from a gazillion tests."

More optimistic is Joel Fishbein, analyst for Philadelphia-based investment firm Janney Montgomery Scott. "We aren't there yet culturally and aren't willing to give up things we know, but I think we will see early adoption in the next 18 months," he said.

In a business sense, adoption could be hastened by the profit motive, because with Pay By Touch, retailers would pay a lower fee for biometric-based transactions than credit cards, he said. Another proponent is Walter Hamilton, chairman of the International Biometric Industry Association, a nonprofit trade group."I don't have to carry cash, check, credit card or debit card," he said. "I can't leave home without my finger."

Pay for the groceries, lock the house, start the car, check in at a doctor's office or log on to a laptop. There's so much the swipe of a fingertip can do.

Pay for the groceries, lock the house, start the car, check in at a doctor's office or log on to a laptop. There's so much the swipe of a fingertip can do.An evolving digital tool, biometric-fingerprint technology holds the promise of replacing or lessening reliance on everyday necessities such as credit cards, key chains and passwords. It even helps registered travelers get through security at Orlando International Airport.

An evangelist of biometrics, Scott Moody is CEO of AuthenTec, a Melbourne company that produces sensors that can read a fingerprint."Looking ahead, I think the use of this technology could become ubiquitous," he said, gazing out the window of his office overlooking the Indian River. "It would just be taken for granted as part of the everyday world."Moody's 8-year-old firm, which employs 89, has grown rapidly, thanks to four infusions of venture capital totaling $63.5 million, with shipments increasing in the past three years from 1.5 million to a projected 7 million to 8 million units in 2006. AuthenTec is among several global suppliers for a market comprising computers, cell phones, home security, autos and building-access controls, presenting a target of about 1 billion sales worth $5 billion to $10 billion this year, Moody said.

Biometric-fingerprint readers are housed in a bit of silicon not much bigger than a fingernail clipping yet powerful enough to capture a fingerprint image that, when magnified, looks like closely packed mountains and valleys in a desert landscape. The silicon slivers are seen as a tool for safeguarding sensitive personal and financial data stored on laptops used by the military, banks, businesses and medical firms. Many business-model laptops now have the biometric devices, said Ray Sawall, Gateway senior manager for professional-notebook management.

Beyond security, convenience could be a major driver for wider adoption in the consumer world, said Forrester Research analyst Jonathan Penn, who sees biometric devices as a tool for making purchases at the supermarket and other stores."I can get through the checkout line faster, and I don't have to carry cash or a debit or credit card," he said.

A fingerprint-scanning device linked to bank or credit-card accounts, developed by Pay By Touch of San Francisco, is in use at about 2,500 sites across the country, including Coast to Coast, a Tampa convenience store.

A fingerprint-scanning device linked to bank or credit-card accounts, developed by Pay By Touch of San Francisco, is in use at about 2,500 sites across the country, including Coast to Coast, a Tampa convenience store.Future uses include the ability to pay at the pump for gas and register for a visit at a doctor's office with a finger swipe, said John Morris, Pay By Touch president.

Individuals seeking to cash payroll or government checks can use a similar biometric tool, called Paycheck Secure, also developed and powered by Pay By Touch technology, at Zions Bank of Utah. "It's convenient for customers, and it keeps us from being defrauded," said David Fuhriman, senior vice president of retail-product management.

Individuals seeking to cash payroll or government checks can use a similar biometric tool, called Paycheck Secure, also developed and powered by Pay By Touch technology, at Zions Bank of Utah. "It's convenient for customers, and it keeps us from being defrauded," said David Fuhriman, senior vice president of retail-product management.Still another version of the technology is a key-chain fob, called plusID, developed by Privaris Inc., a privately held firm in Charlottesville, Va. The 1-inch-long device, which uses an AuthenTec sensor, is a security tool to unlock doors and log on to computers at businesses, Privaris President and CEO Barry Johnson said. It could also be used to lock and unlock home and car doors, he said. But before biometric technology replaces credit cards and makes the key ring obsolete, barriers remain, industry analysts and experts said.

The $5 sensors are still too pricey for mass adoption; there is little awareness of and even less demand for them; and some concerns linger about how secure they really are, experts said. "There's value in it for locking a phone or navigating games," said Chris Bierbaum, Sprint Nextel Innovation Manager."But the price has to come down for a cell-phone carrier to deploy it. And I want to see more testing on security. I need to see confirmation from a gazillion tests."

More optimistic is Joel Fishbein, analyst for Philadelphia-based investment firm Janney Montgomery Scott. "We aren't there yet culturally and aren't willing to give up things we know, but I think we will see early adoption in the next 18 months," he said.

In a business sense, adoption could be hastened by the profit motive, because with Pay By Touch, retailers would pay a lower fee for biometric-based transactions than credit cards, he said. Another proponent is Walter Hamilton, chairman of the International Biometric Industry Association, a nonprofit trade group."I don't have to carry cash, check, credit card or debit card," he said. "I can't leave home without my finger."

.jpg)