This week, Pay by Touch announced the launch of PBT Online, a biometric payment system used from a laptop or home computer. Last October, after raising $130M, Pay By Touch acquired the assets of ATM Direct, including its patent-pending all-software solution allowing online shoppers to securely use their PIN debit cards or ATM cards to pay. The acquisition enhances the Pay By Touch Merchant Services suite of payment processing products.

This week, Pay by Touch announced the launch of PBT Online, a biometric payment system used from a laptop or home computer. Last October, after raising $130M, Pay By Touch acquired the assets of ATM Direct, including its patent-pending all-software solution allowing online shoppers to securely use their PIN debit cards or ATM cards to pay. The acquisition enhances the Pay By Touch Merchant Services suite of payment processing products. The new PBT Online payment system has not yet incorporated the ATM Direct technology, but when it does, look out PayPal. This product will be 15 times more secure and cost less than half of what PayPal can charge.

ATM Direct: Enhances the Entire Value Chain

ATM Direct is a service of Pay By Touch, the world leader in biometric payments and authentication at the point-of-sale.

ATM Direct is a service of Pay By Touch, the world leader in biometric payments and authentication at the point-of-sale.ATM Direct is a certified PIN-debit and PIN-less payment processor. Our services and facilities have been audited and certified to meet or exceed the standards and regulatory requirements of the EFT industry.

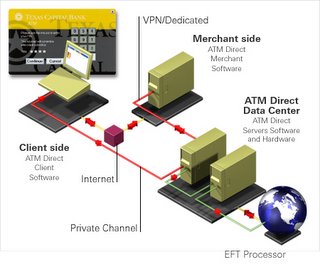

ATM Direct is a payment acquirer - processor that enables Merchants, EFT Networks, and Financial Institutions to provide PIN-based debit payments and authentication services over the Internet.

ATM Direct, from Pay by Touch, is a software-only (no hardware required) PIN Debit solution, the only one in the world, and it's been audited and certified compliant with U.S, EFT regulatory requirements.

ATM Direct, from Pay by Touch, is a software-only (no hardware required) PIN Debit solution, the only one in the world, and it's been audited and certified compliant with U.S, EFT regulatory requirements.PIN-debit transactions are fully authenticated, real-time cash transactions. PIN-debit payments require a Personal Identification Number or PIN with every transaction. Your PIN is legal proof of your identity and “authenticates” your transactions, virtually eliminating online fraud.

ATM Direct represents a significant breakthrough for Internet commerce by providing secure cash payments and identity authentication through a personal computer and use of bank-issued PIN.

ATM Direct’s Internet PIN-debit transactions process over the world’s bank and EFT networks like conventional transactions and do not require any changes to bank or network infrastructure and processes. This allows rapid and low cost adoption worldwide.

ATM Direct turns over 580 million computers into secure payment terminals allowing consumers everywhere to immediately pay and transfer cash electronically from their computer.

PIN debit has been in use for over 20 years at ATM Machines and retail store checkout and is proven to be the most secure payment method available. Now a consumer can use their PIN-based debit card to pay for purchases on the Internet simply and easily. With ATM Direct from Pay by Touch, you use the same bank issued PIN that you already use at ATM's or retail stores everyday. There are no new devices, passwords or registrations or PIN's required.

If you are concerned about Internet security, PIN debit provides the best alternative for you. Only you know your PIN number and which proves that it is your card. Help us to protect you, your money and your identity by using ATM Direct. ATM Direct never, ever shares personal information with outside third-parties and has no access to your personal or financial information.

ATM Direct downloads a secure PIN-pad to your machine. This download occurs just like your anti-virus software. This PIN-pad is wrapped with and protected by industry leading security software technologies and protections that ensure that no hacker, logger or spyware can ever see or access your PIN.

e-Merchants: Consumer research shows that PIN-debit is the most popular and trusted from of card payment. Consumers prefer the safety and security of PIN-debit. ATM Direct enables PIN-debit payments on your web site in much the same way as PIN-debit in a brick-and-mortar store. PIN debit does not change the flow of your site, does not redirect any customer off of your site and saves you money. It also enables PIN-only cards, historically known as ATM cards, to be used for Internet purchases for the first time.

ATM Direct enables PIN-debit payments on your web site in much the same way as PIN-debit in a brick-and-mortar store. PIN debit does not change the flow of your site, does not redirect any customer off of your site and saves you money. It also enables PIN-only cards, historically known as ATM cards, to be used for Internet purchases for the first time.

On the Internet today, there are more consumer debit payment transactions than credit. On the Internet, "signature" debit transactions are processed at "card not present" credit card interchange rates. bWith ATM Direct, payments can be easily moved to the lower cost PIN-debit transactions, significantly reducing your processing fees and risks.

Adoption is easy. The ATM Direct service can be quickly implemented. There is no charge for our software. ATM Direct provides the implementation guidelines, software, code plug-ins and a Merchant Services support team at no cost to you.

ATM Direct has developed a savings calculator worksheet that allows you to estimate the savings from lower processing fees, charge backs and fraud and the new revenues from new customers when you utilize ATM Direct's Internet PIN-Debit.

The ability to use ATM cards for POS on the Internet is expected to generate in excess of $18 Billion in online sales by 2008.

ATM and Debit cards are now almost universally owned and accepted. PIN debit transactions are now the fastest growing type of payment in stores across the U.S. So why not PIN-Debit purchasing over the Internet—where purchasing is skyrocketing?

Debit is already the most popular form of card payment. It overtook credit in 2005. A recent study showed that consumers routinely use PIN-debit payments at ATM machines, conventional retail, convenience stores and gas stations. 76% of consumers like this payment form. 36% prefer this payment method which is higher than any other form of card payment. Debit card transactions already outnumber credit card transactions on the Internet.

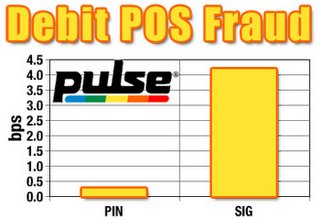

Credit cards were not designed for use on the Internet. With no card present, and no signature available, the risk is too high and fraud is too prevalent Lower cost debit cards already outnumber credit card transactions on the Internet. RESULT: INTERNET RETAILERS ACCEPT LOWER COST DEBIT CARDS BUT PAY THE MUCH HIGHER CREDIT CARD (NOT PRESENT) INTERCHANGE RATE. PIN DEBIT IS 15 TIMES MORE SECURE THAN SIGNATURE DEBIT.

RESULT: INTERNET RETAILERS ACCEPT LOWER COST DEBIT CARDS BUT PAY THE MUCH HIGHER CREDIT CARD (NOT PRESENT) INTERCHANGE RATE. PIN DEBIT IS 15 TIMES MORE SECURE THAN SIGNATURE DEBIT.

WHY PAY DOUBLE to INCREASE RISK? PIN Debit from Pay by Touch can CUT PROCESSING FEES IN HALF with a payment that is 15 times more secure.

PIN-related fraud costs financial institutions approximately $.04 per card per year, while signature debit losses amount to $1.15 per card annually.

PIN Debit is Real-Time Electronic Cash: PIN-debit provides real-time guaranteed funds making it an ideal cash-like payment method for Internet purchases and direct bill payment.

Internet PIN Debit Provides Consumers A Choice for Payments: PIN-debit is an ideal payment alternative for 37% of consumers that don't qualify for credit cards or those consumers who have no remaining credit or dislike using credit cards.

Internet PIN Debit Opens International Markets: PIN-debit is the most widely used card payment method in the world and is often the only card payment alternative in countries where credit card and "signature" debit cards are not widely used or not available.

Internet PIN Debit is Safe, Secure and Private: Credit card numbers can be stolen and used fraudulently. Recently, there was one incident where 5.6 million credit card numbers were stolen on the Internet.

The ATM Direct solution never shares the PIN or exposes it to a third-party. This level of security prevents this type of theft on the Internet. The privacy  that PIN Debit provides the consumer is important because 90% of consumers want more privacy and security with their financial transactions on the Internet. 56% of all consumers would purchase more on the Internet if they were able to use their PIN Debit cards.

that PIN Debit provides the consumer is important because 90% of consumers want more privacy and security with their financial transactions on the Internet. 56% of all consumers would purchase more on the Internet if they were able to use their PIN Debit cards.

ATM Direct’s Internet PIN-debit transactions process over the world’s bank and EFT networks like conventional transactions and do not require any changes to bank or network infrastructure and processes. This allows rapid and low cost adoption worldwide.

In closing, when Pay by Touch incorporates the ATM Direct Technology into Pay by Touch Online, there's reason anybody (except eBAY which owns PayPal) who sells products online wouldn't use them. It would be fiscally irresponsible to their shareholders not to.

.jpg)