ATM Direct, a company that Pay by Touch has been working with for the last two years and one that they acquired in their acquistion spree last December, is beta live.

ATM Direct, a company that Pay by Touch has been working with for the last two years and one that they acquired in their acquistion spree last December, is beta live.ATM Direct has a patent pending "software only" solution for Internet PIN debit. PIN Debit is not yet available for internet retailers to use as a form of payment. When Pay by Touch makes it available, retailers will save approximately half of what they currently pay in interchange fees which translates to savings for their customers.

Here are some related links to previous posts which are also listed at the bottom of this post.

An EFT Network First...Biometric PIN Debit

Pay by Touch to Test PIN Debit on Web

A Closer Look at PBT's ATM Direct

Click here to visit ATM Direct, otherwise, here is an overview:

Real-time, PIN-debit payments over the Internet

PIN-debit has been proven to be the most secure payment method by over 20 years of retailing use. Consumers and merchants prefer PIN-debit over any other card based payment method.

atmdirect is the first software-only PIN-debit service for the Internet.

It delivers the same benefits PIN debit provides "brick and mortar" retailers including: lower costs, lower risks, ease of use and real-time, guaranteed funds.

atmdirect is the only software based payment service that meets or exceeds industry standards for PIN-based transactions.

Multi-Factor Authentication Solutions for the Internet

atmdirect delivers a complete, patent-pending, software-only solution for multi-factor authentication that meets or exceeds FFIEC recommendations for online banking.

Their proprietary solution utilizes advanced PKI, device intelligence, geolocation and behavioral analysis to protect consumers while transacting on the Internet. The authentication framework built to enable PIN-debit on the internet is now available as a FFIEC compliant solution for online banking.

What is atmdirect?

- atmdirect is a Pay By Touch company, the world leader in biometric payments and authentication at the point-of-sale.

- atmdirect is a certified PIN-debit and PIN-less acquirer-processor.

- atmdirect facilities have been audited and certified to meet or exceed the standards and regulatory requirements of the EFT industry.

- atmdirect provides PIN-based payments and authentication services to the Internet.

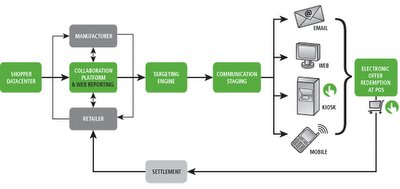

- atmdirect is driving a "cooperative" model to enhance the entire supply chain by leveraging the existing infrastructures and distribution channels.

- atmdirect dramatically expands the global customer base of the Internet by enabling the use of PIN-debit on the Internet.

- atmdirect is the only company in the world that can provide these services with a software-only solution.

- atmdirect's solution does not require any changes to bank or network infrastructure enabling rapid and low cost adoption worldwide.

- atmdirect represents a significant breakthrough for Internet commerce and online banking by providing secure payments and authentication.

- atmdirect is the emerging provider of software based multi-factor authentication services for online banking and consumers.

A Technology Breakthrough

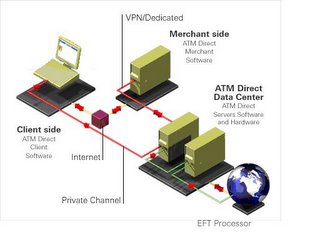

ATM Direct's patent-pending technology allows for the secure and private entry of the PIN on a computer. When paying with PIN-debit, the consumer simply enters his PIN using their mouse on a graphical PIN-pad on their screen. The PIN is authenticated directly with the consumer’s bank through our secure data center by routing the transaction to the appropriate EFT network without passing the transaction through the merchant’s system. The PIN is never in the clear and cannot be logged or hacked. This service is a software based solution that the customer simply downloads when prompted by the merchant or a trusted partner.

INTERNET PIN-DEBIT PAYMENTS

INTERNET PIN-DEBIT PAYMENTS

The most secure and most widely accepted payment standard in the world is coming to the Internet.

Use of debit cards on the Internet continues to grow and now exceeds the use of credit cards. We deliver a unique, patent-pending, software-only solution that enables the secure use of existing bank-issued debit cards with their PINs. Internet PIN-Debit will dramatically reduce payment costs and fraud.

MORE SECURITY AND PRIVACY

The PIN authenticates the cardholder’s identity. We ensure that the consumer’s PIN is never in the clear, never available on the merchant site or in the consumer’s computer.

Benefits to Internet Retailers and Financial Institutions

Internet PIN Debit and our authentication framework combined with Personalized Marketing solutions will lower your processing costs, decrease fraud, protect your consumers online and increase your sales and profitability.

Our authentication platform provides you a real-time multi-factor authenticaion solution that meets and exceeds FFIEC recommendations, easy to adopt, secure and compliant, our customer focused solution insures your online brand is secure and protected during any online transaction.

PIN debit has been in use for over 20 years at ATM Machines and retail store checkout and is proven to be the most secure payment method available. Now you can use your PIN-based debit card to pay for purchases on the Internet simply and easily just like you do with your card and PIN at the cash register in a retail store every day. There are no new devices, passwords or registrations required.

How to Get ATM Direct

It's simple! You simply downloand our secure proprietary PIN-pad to your PC or laptop. This download occurs just like your anti-virus software. This PIN-pad is wrapped with and protected by industry leading security software technologies and protections that ensure that no hacker, logger or spyware can ever see or access your PIN.

For further information on Pay by Touch Online and ATM Direct please see my previous posts which I have listed below for your convenience:

A Closer Look at PBT's ATM Direct

Pay by Touch to Test PIN Debit on Web

An EFT Network First...Biometric PIN Debit

Overcoming the Barrier to Adoption

Pay by Touch Online

A Closer Look at PBT Online

.jpg)